Sss Monthly Contribution 2025 Self Employed

BlogSss Monthly Contribution 2025 Self Employed. Updated in the payment of the sss. Msc x contribution rate = monthly contribution amount.

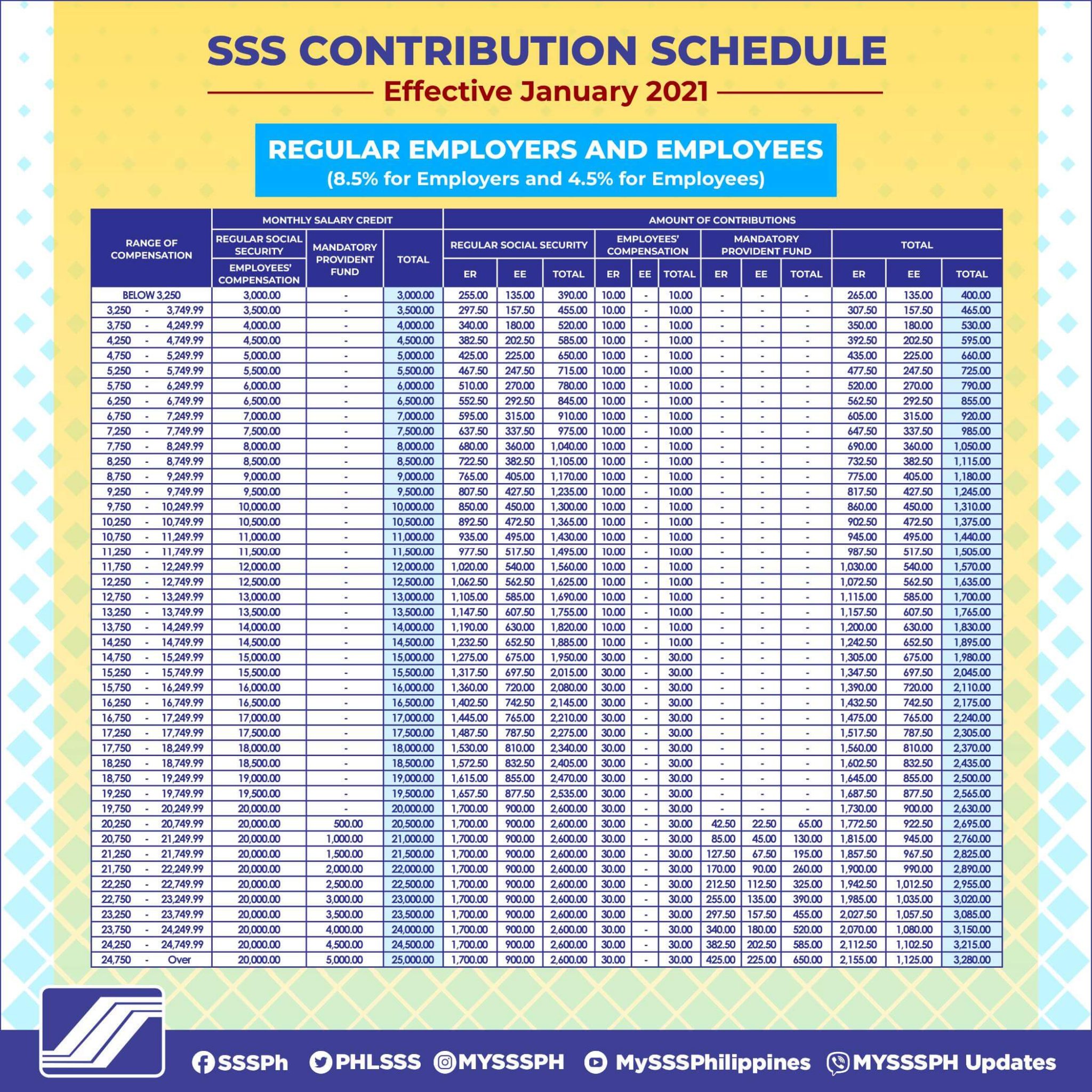

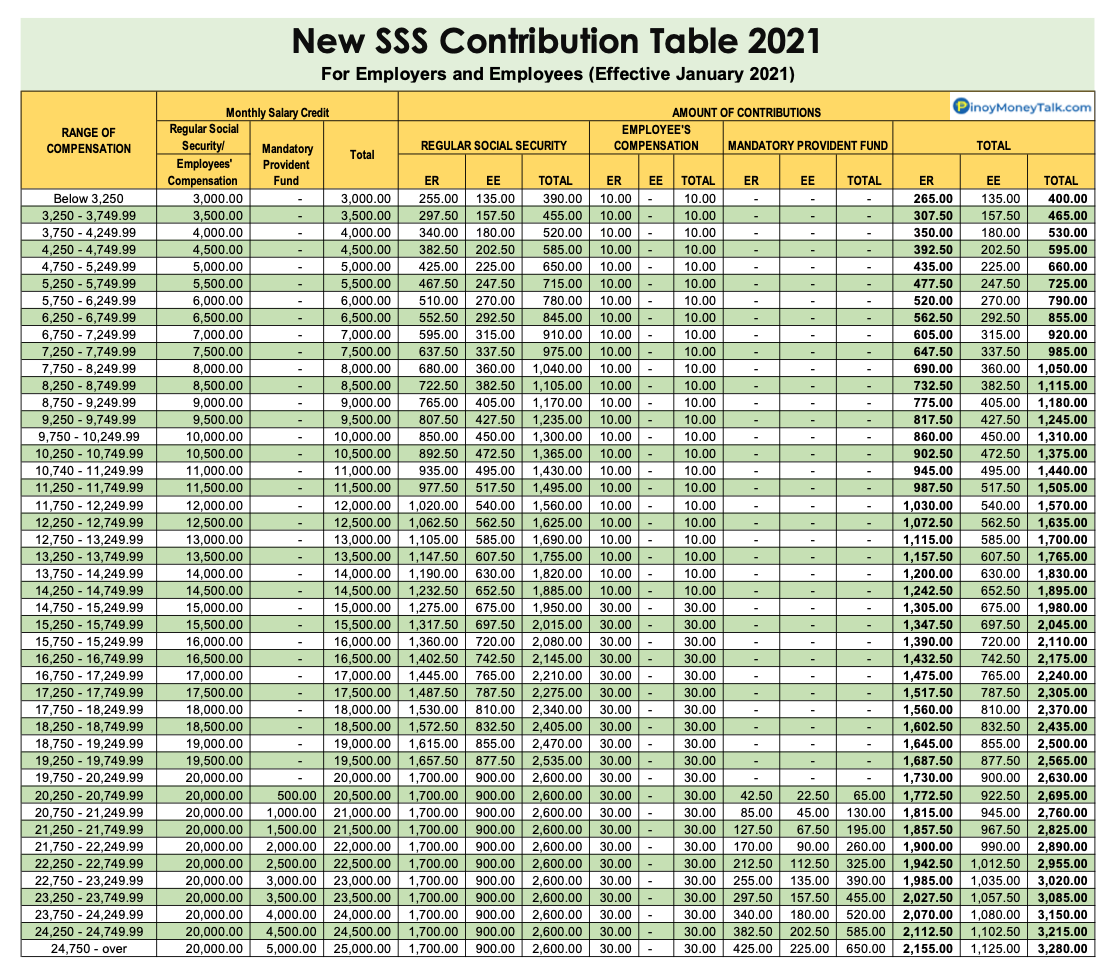

Starting january 2025, all employed sss members with monthly salary credit of at least p24,750 will need to contribute p650.00 to the mandatory sss provident fund. On the other hand, the maximum.

Starting january 2025, all employed sss members with monthly salary credit of at least p24,750 will need to contribute p650.00 to the mandatory sss provident fund.

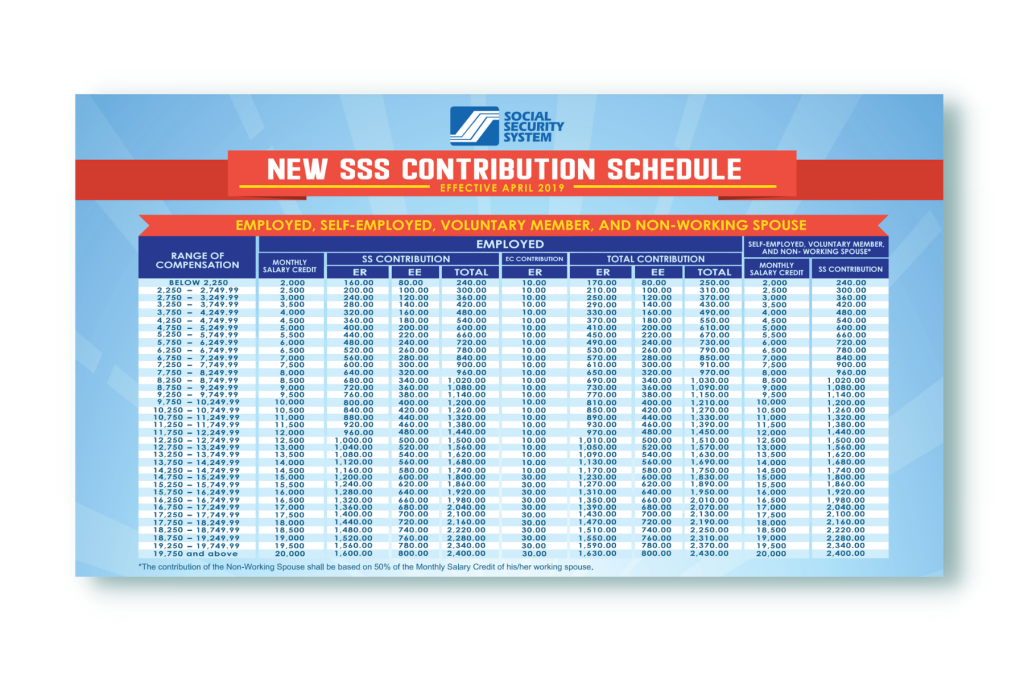

SSS SELF EMPLOYED NEW CONTRIBUTIONS YouTube, Meaning if your salary is less than ₱3,000, your contribution rate will be pinned on this contribution range. In 2025, the social security system (sss) in the philippines has set the contribution rates at 9.5% for employers and 4.5% for.

SSS Contribution Table 2025 What's New? Para sa Pinoy, As sss contribution are not required from. In 2025, the social security system (sss) in the philippines has set the contribution rates at 9.5% for employers and 4.5% for.

SSS Online Registration and Steps to Check SSS Your Contribution Online, In 2025, the social security system (sss) in the philippines has set the contribution rates at 9.5% for employers and 4.5% for. Sss contribution tables for employers and employees 2025.

SSS Monthly Contribution Table Guide in the Philippines Digido, Here are the eligibility requirements for application: Meaning if your salary is less than ₱3,000, your contribution rate will be pinned on this contribution range.

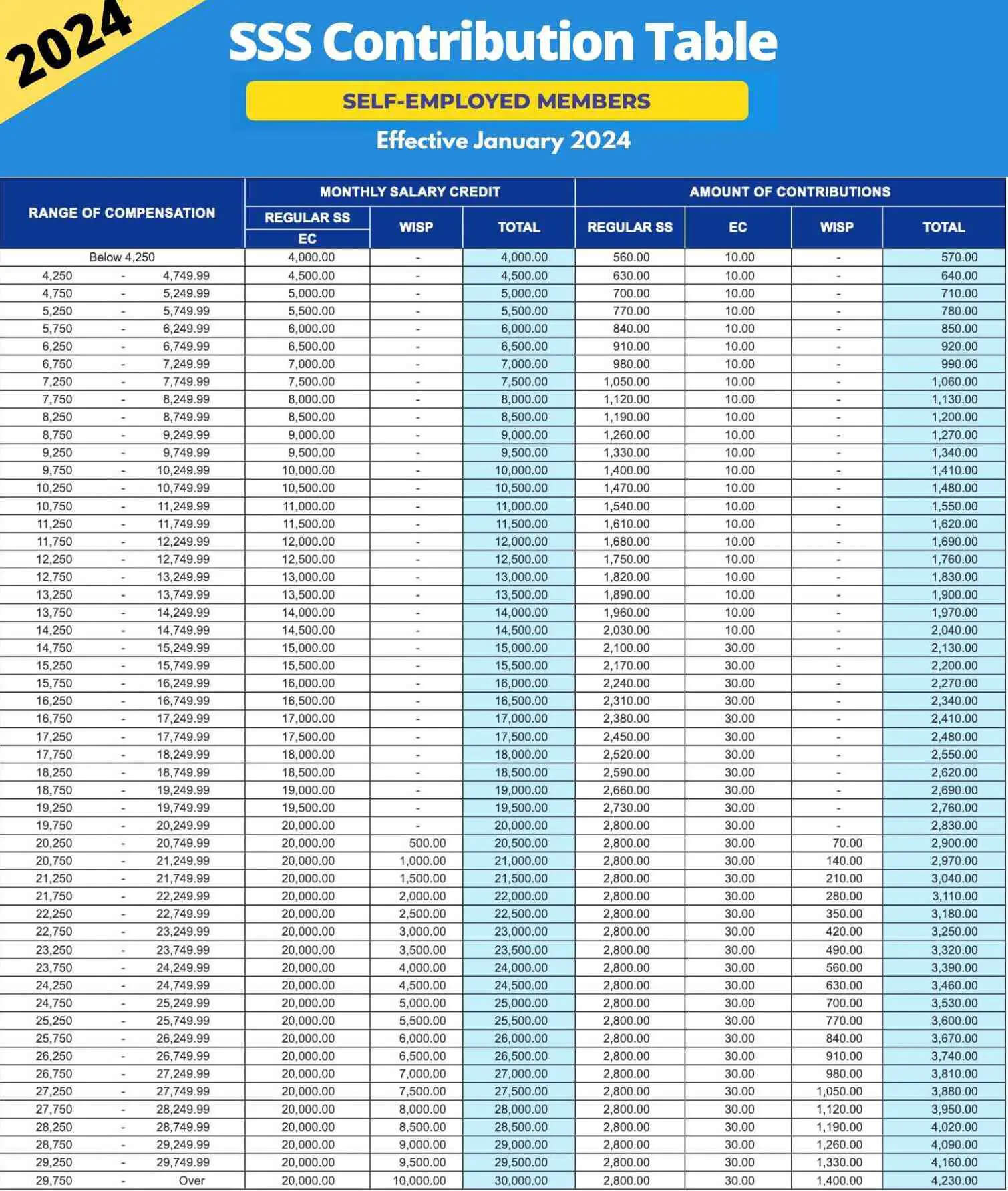

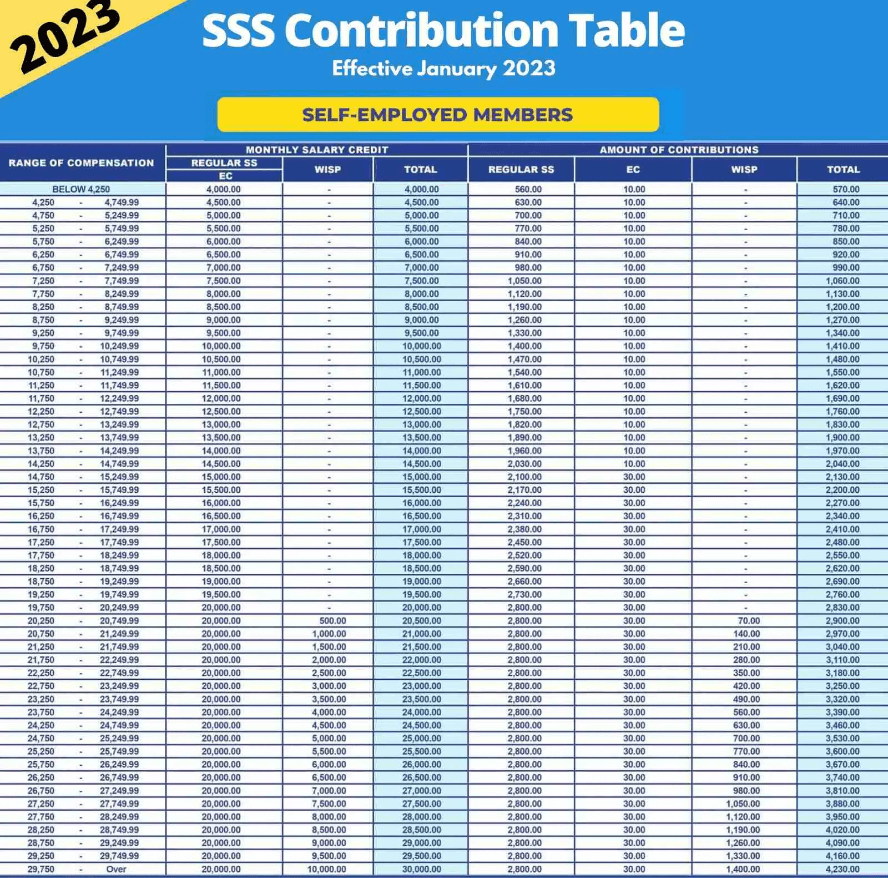

SSS Monthly Contribution Table Guide in the Philippines Digido, For 2025, the sss contribution rate is still 14%, as with the previous year. Msc x contribution rate = monthly contribution amount.

SSS Monthly Contribution Table Guide in the Philippines Digido, Sss contribution tables for employers and employees 2025. The social security system contribution table, also called sss, is a table showing the amount of contribution that needs to be made by.

What’s New SSS Contribution Table 2025 QNE Software, Updated in the payment of the sss. The minimum monthly salary credit will be set to php 4,000, and the maximum will be php 30,000.

5 MustKnow Facts to Claim Your SSS Unemployment Benefit Cash Mart, Has posted at least 36 monthly contributions in the sss account. The social security system contribution table, also called sss, is a table showing the amount of contribution that needs to be made by.

(2025) SSS Contribution Table for Employees, SelfEmployed, OFW, As sss contribution are not required from. On the other hand, the maximum.

How to Compute Our SSS Monthly Contribution 2025 & 2025 eezi, For 2025, the sss contribution rate is still 14%, as with the previous year. On the other hand, the maximum.

Starting january 2025, all employed sss members with monthly salary credit of at least p24,750 will need to contribute p650.00 to the mandatory sss provident fund.