Nebraska Tax Tables 2025

BlogNebraska Tax Tables 2025. (ap photo/pat wellenbach, file) portland, maine (ap) — democrat joseph. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

The tax tables below include the tax rates, thresholds and allowances included in the nebraska tax. Nebraska annual salary after tax calculator 2025.

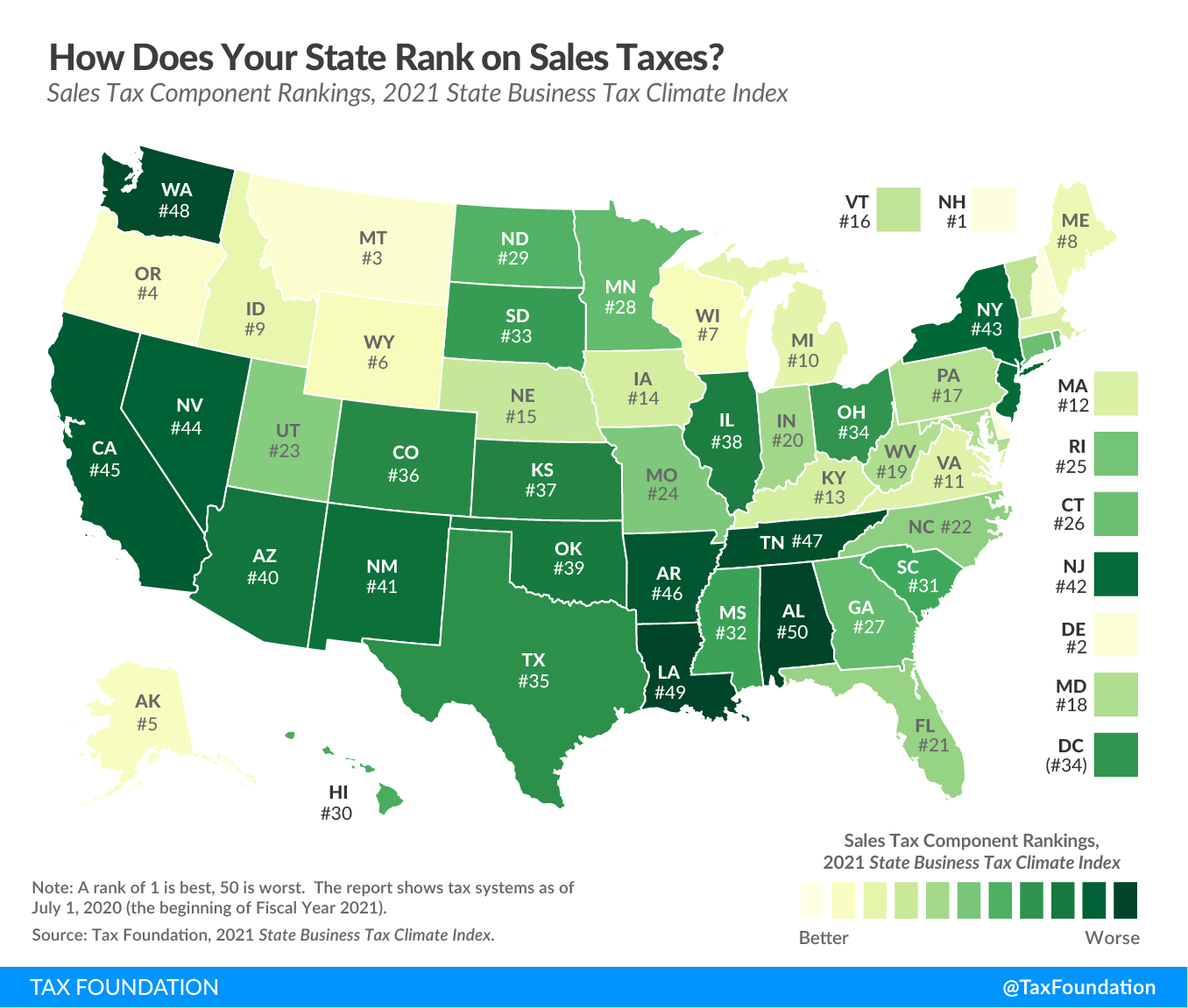

Usa Tax Brackets 2025 Idette Karole, The agency will reduce the. Last updated 7 february 2025.

Tax rates for the 2025 year of assessment Just One Lap, Rate decreases will continue annually through 2027. Updated for 2025 with income tax and social security deductables.

Federal Tax Table For 2025 Becca Carmine, If you make $70,000 a year living in delaware you will be taxed $11,042. The nebraska department of revenue is issuing a new nebraska circular en for 2025.

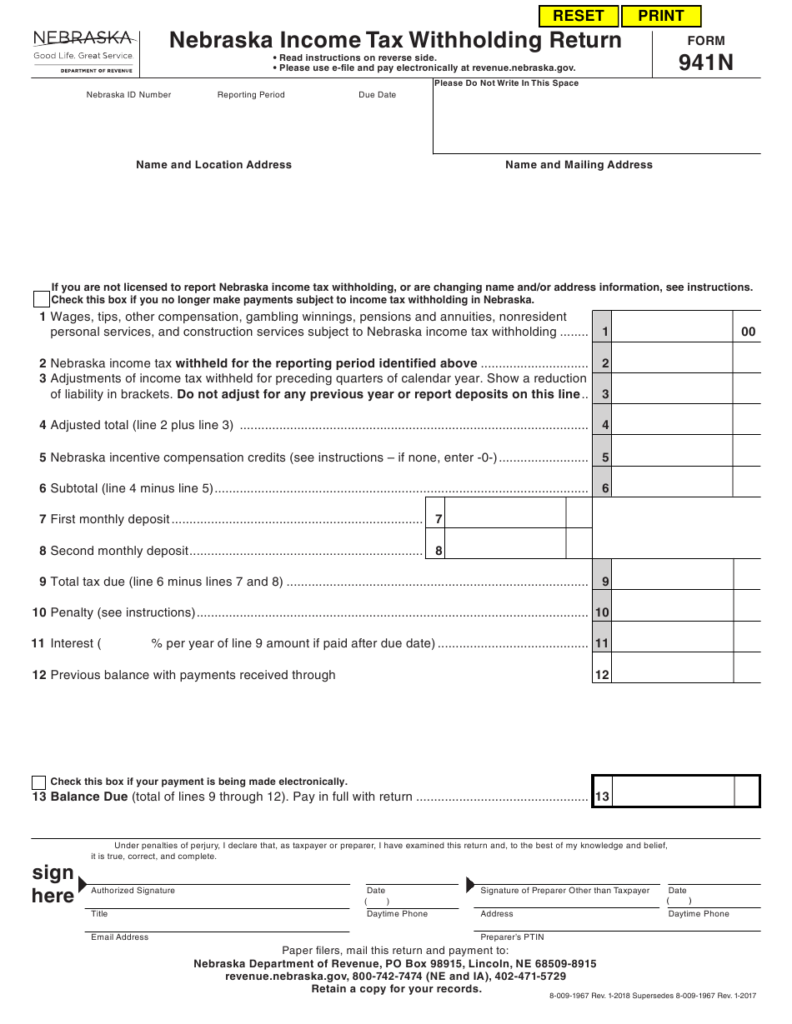

Nebraska Withholding Tax Form Federal Withholding Tables 2025, The agency will reduce the. Lb 754 includes a reduction of individual income tax rates beginning in 2025.

1845.102k Salary After Tax in Nebraska US Tax 2025, Find your pretax deductions, including 401k, flexible. The nebraska department of revenue is issuing a new nebraska circular en for 2025.

164.525k Salary After Tax in Nebraska US Tax 2025, The tax tables below include the tax rates, thresholds and allowances included in the nebraska tax. Lou ann linehan of omaha, chair of.

Where Can I Find Tax Tables? mutualgreget, Find your pretax deductions, including 401k, flexible. Using the nebraska income tax calculator 2025.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Nebraska State Tax Rate 2025 Federal Withholding Tables 2025, Find your pretax deductions, including 401k, flexible. All tables within the circular en have changed, and should be used for wages, pensions.

27.806k Salary After Tax in Nebraska US Tax 2025, Under lb 754, the top individual income tax rate is lowered from 6.84% to 5.84% for tax year 2025, 5.2% for 2025, 4.55% for 2026 and 3.99% for 2027 and. Nebraska's 2025 income tax ranges from 2.46% to 6.64%.

How to Fill out Form W4 in 2025 (2025), Income tax tables and other tax information is sourced from. The federal income tax has seven tax rates in 2025:

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)